Beneath the Copper Sky: AZ Mining Investor and the Resurgence of Arizona’s Mineral Wealth

Arizona, a land synonymous with sun-drenched deserts, towering saguaros, and the Grand Canyon, holds another, perhaps less romanticized but equally vital, identity: the "Copper State." For centuries, its rugged terrain has yielded immense mineral wealth, shaping its economy, infrastructure, and very identity. In an era where global supply chains are under scrutiny and the demand for critical minerals skyrockets, Arizona’s subterranean treasures are once again taking center stage. Navigating this complex, high-stakes landscape requires more than just geological expertise; it demands shrewd financial acumen, market insight, and a keen understanding of both opportunity and risk. This is where entities like "AZ Mining Investor" step in, serving as a crucial compass for those looking to tap into Arizona’s enduring mineral legacy and its burgeoning future.

AZ Mining Investor, whether conceived as a dedicated platform, a collective of analysts, or a guiding philosophy, embodies the pulse of investment within Arizona’s mining sector. It’s a resource designed to demystify the intricacies of mineral exploration, extraction, and market dynamics specific to the Grand Canyon State. Its mission is to bridge the gap between geological potential and capital investment, guiding both seasoned institutional investors and burgeoning retail participants through the unique opportunities and challenges that define Arizona’s mining landscape. In a world increasingly reliant on metals for everything from electric vehicles to renewable energy infrastructure, understanding the localized expertise offered by such a dedicated entity becomes paramount.

Arizona’s mining history is as rich and layered as the geological formations beneath its surface. From the early Spanish explorers who sought gold and silver, to the relentless prospectors of the 19th century, and the industrial giants who built vast copper operations, mining has been the bedrock of the state’s economic development. "Arizona has consistently been a top-tier jurisdiction for mineral production in the United States, primarily due to its world-class copper deposits," notes a recent industry report. The state is not merely a historical footnote; it remains the leading copper-producing state in the U.S., accounting for approximately two-thirds of the nation’s output. This enduring legacy is a testament to the sheer scale of its mineral endowment and the resilience of its mining industry.

However, the modern mining landscape is far more sophisticated than the pick-and-shovel days. It involves vast capital expenditures, cutting-edge technology, stringent environmental regulations, and a volatile global commodity market. This is precisely where the specialized insight of AZ Mining Investor becomes indispensable. Its analysis typically delves into several key areas:

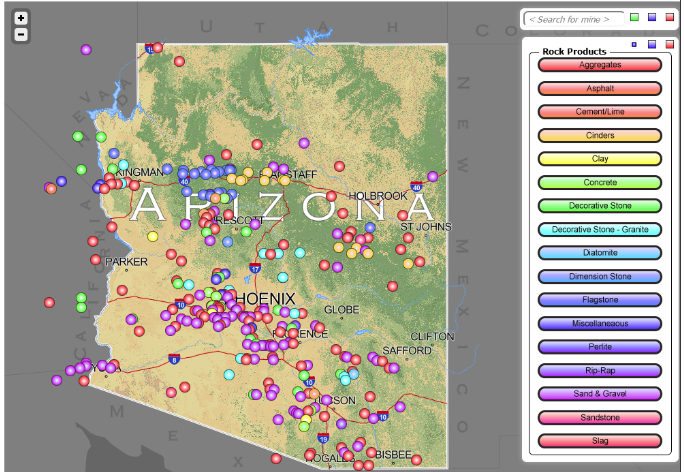

1. Geological Potential and Exploration: Arizona is renowned for its porphyry copper deposits, but it also hosts significant reserves of molybdenum, silver, gold, and increasingly, critical minerals like lithium and rare earth elements. AZ Mining Investor would scrutinize exploration data, drilling results, and geological surveys to identify promising new projects or expansions of existing ones. "The beauty of Arizona is that even after centuries of mining, new discoveries are still being made, and advancements in exploration technology allow us to re-evaluate previously overlooked areas," explains an analyst affiliated with a hypothetical AZ Mining Investor. "We look for projects with strong geological indicators, experienced management teams, and a clear path to resource definition."

2. Economic Impact and Strategic Importance: Mining is a significant economic engine for Arizona, generating thousands of high-paying jobs, substantial tax revenues, and contributing billions to the state’s GDP. Beyond local economics, Arizona’s minerals play a critical role in national security and the global energy transition. Copper is fundamental to electrification; lithium is essential for batteries; and rare earths are vital for advanced technologies. As the U.S. seeks to onshore critical mineral supply chains, Arizona’s position as a reliable domestic source becomes even more strategic. AZ Mining Investor highlights companies that are not only financially viable but also contribute positively to the local economy and align with broader national strategic objectives.

3. Navigating the Investment Landscape: The mining sector is notoriously cyclical and capital-intensive. Investors face choices between established major producers with stable cash flows and junior exploration companies offering high-risk, high-reward potential. AZ Mining Investor would offer nuanced analysis, distinguishing between the speculative nature of early-stage exploration and the more predictable returns of production. It would evaluate factors such as commodity price forecasts, geopolitical stability impacting supply and demand, and the specific regulatory environment in Arizona. "Understanding the commodity cycle is key," advises a market brief from AZ Mining Investor. "While copper prices are currently robust, we advise investors to consider the long-term fundamentals driven by global decarbonization, rather than short-term fluctuations."

4. Environmental, Social, and Governance (ESG) Factors: In the 21st century, responsible mining practices are non-negotiable. Environmental stewardship, community engagement, and strong corporate governance are increasingly vital for investor confidence and project viability. AZ Mining Investor dedicates significant attention to companies’ ESG performance, evaluating their water management strategies, land reclamation efforts, community benefit agreements, and adherence to regulatory standards. "ESG is no longer a peripheral concern; it’s central to a project’s bankability and social license to operate," states an expert quoted by AZ Mining Investor. "We prioritize companies that demonstrate a genuine commitment to sustainable practices and positive community relations, as these are often the ones that achieve long-term success." This focus helps investors identify operations that mitigate risks associated with environmental liabilities and social opposition, which can significantly impact project timelines and costs.

5. Technological Innovation and the Future of Mining: The industry is undergoing a technological revolution, with advancements in automation, artificial intelligence, remote sensing, and data analytics transforming exploration, extraction, and processing. Arizona’s mining companies are often at the forefront of these innovations, seeking to improve efficiency, reduce environmental impact, and enhance safety. AZ Mining Investor would keep its finger on the pulse of these technological shifts, identifying companies that are early adopters or developers of game-changing technologies, thereby offering a competitive edge and potentially higher returns. The integration of AI for geological modeling or autonomous hauling systems, for instance, represents significant operational improvements.

Challenges and Opportunities:

While Arizona’s mining prospects are bright, they are not without challenges. Water scarcity in the desert state is a perpetual concern, demanding innovative water recycling and conservation technologies. Permitting processes, while robust, can be lengthy and complex. Furthermore, balancing economic development with environmental protection and indigenous land rights requires continuous dialogue and thoughtful solutions. AZ Mining Investor would also address these hurdles, providing insights into how companies are tackling them and which ones are best positioned for success in a demanding regulatory and social environment.

Despite these challenges, the opportunities remain compelling. The accelerating global demand for critical minerals, driven by the transition to a green economy, ensures a robust market for Arizona’s output. The state’s established infrastructure, skilled workforce, and supportive regulatory framework (compared to many other jurisdictions) make it an attractive location for mining investment. As an AZ Mining Investor hypothetical report might conclude: "Arizona isn’t just riding the wave of the critical minerals boom; it’s helping to create it. For investors with a long-term vision and a commitment to responsible resource development, the opportunities beneath the copper sky are as vast as the desert itself."

In essence, AZ Mining Investor serves as more than just a source of data; it’s an interpreter of a complex, vital industry. It translates geological potential into financial opportunity, navigates regulatory labyrinths, and champions responsible practices. By offering a focused lens on Arizona’s unique mining ecosystem, it empowers investors to make informed decisions, contributing to the state’s economic vitality and playing a critical role in supplying the minerals essential for the world’s sustainable future. As the world increasingly looks to its foundational elements to build tomorrow, Arizona, guided by insightful analysis, continues to prove its worth, one valuable ore at a time.