CPKC: Forging a New North American Rail Corridor

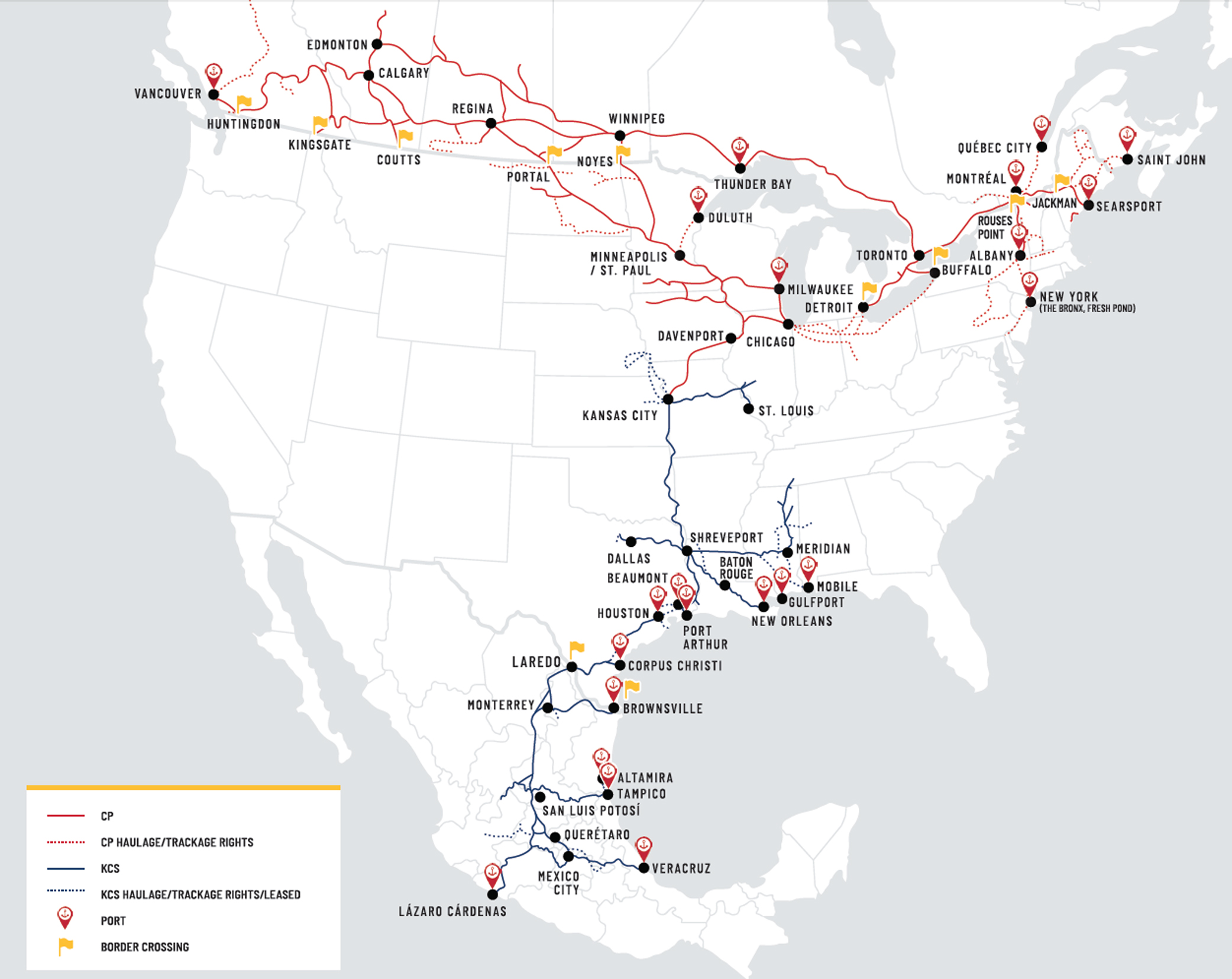

In an era defined by global supply chain complexities and the ever-present demand for efficiency, the rail industry has undergone a monumental transformation. At the heart of this shift lies Canadian Pacific Kansas City (CPKC), the first and only single-line railroad connecting Canada, the United States, and Mexico. Born from the historic merger of Canadian Pacific Railway (CP) and Kansas City Southern (KCS), CPKC represents not just a new name on the tracks, but a strategic realignment of North American trade routes, promising unprecedented connectivity and a revitalized vision for cross-border logistics.

The journey to CPKC’s creation was a saga of ambition, competition, and regulatory scrutiny. For years, the North American rail map was dominated by a handful of Class 1 railroads, each operating within its own geographic silo, necessitating complex and often time-consuming interchanges for goods moving across the continent. The vision for a seamless north-south corridor, however, had long captivated industry leaders.

The Battle for KCS

The catalyst for CPKC came with the pursuit of Kansas City Southern, a crucial railway whose network stretched from the heartland of the U.S. deep into Mexico, boasting unique access to key automotive manufacturing hubs and port facilities. KCS, despite being the smallest of the Class 1 railroads, held an outsized strategic value due to its Mexico operations and its north-south orientation.

Canadian Pacific, led by its dynamic CEO Keith Creel, saw the potential for a transformative combination. Creel, a veteran of Precision Scheduled Railroading (PSR) principles, envisioned a lean, efficient operation spanning three countries. In March 2021, CP launched its initial bid for KCS, proposing a $29 billion acquisition. However, the bid quickly ignited a fierce bidding war with rival Canadian National (CN), which subsequently tabled a higher, $33.6 billion offer.

The ensuing battle for KCS became one of the most closely watched corporate sagas in recent memory, drawing intense scrutiny from regulators, particularly the U.S. Surface Transportation Board (STB). The STB, the primary economic regulator of U.S. railroads, ultimately sided with CP’s proposal, citing its “end-to-end” nature which was less likely to reduce competition than CN’s "parallel" network, which would have significantly overlapped with KCS in some areas. The STB’s decision hinged on the public interest: CP’s acquisition was seen as enhancing competition and offering a new, viable single-line option for shippers, rather than simply consolidating existing routes.

On April 14, 2023, the merger officially closed, creating CPKC and marking the dawn of a new era for North American freight. "This is a historic day for our company, our customers, and for North American trade," stated Keith Creel on the day of the merger. "We have built the first and only railroad connecting Canada, the U.S. and Mexico, unlocking a new level of efficiency and connectivity that will benefit industries across the continent."

The Strategic Imperative: Single-Line Efficiency

The core strategic advantage of CPKC lies in its "single-line haul" capability. Previously, a shipment moving from, say, Calgary, Alberta, to Mexico City would likely involve multiple railroads, requiring goods to be interchanged at various points along the way. Each interchange adds time, cost, and the risk of damage or delay. With CPKC, that entire journey can be completed on a single network, under a single management team, with a single bill of lading.

"Imagine the difference," explains Sarah Jenkins, a supply chain analyst with Logistics Insights Group. "Instead of multiple handoffs, which are notorious for creating dwell time and uncertainty, you have a seamless flow. This dramatically reduces transit times, improves reliability, and allows shippers to plan their logistics with far greater precision. It’s a game-changer for just-in-time inventory systems and complex manufacturing supply chains."

This streamlined operation is particularly beneficial for high-value goods and time-sensitive cargo. The combined network spans approximately 20,000 miles (32,000 kilometers), connecting key ports on the Atlantic, Pacific, and Gulf coasts, as well as major metropolitan and industrial centers across the three countries. From the grain fields of the Canadian Prairies to the automotive factories of Central Mexico, CPKC offers a direct link.

Key Corridors and Economic Impact

CPKC’s network is strategically positioned to capitalize on some of North America’s most vital trade flows.

- Automotive: Mexico has become a powerhouse in automotive manufacturing, and KCS’s pre-existing network was deeply embedded in this industry, serving major assembly plants. CPKC now provides a direct rail link for finished vehicles and auto parts from Mexico to the vast consumer markets and manufacturing centers of the U.S. and Canada. This is crucial for the integrated North American auto industry, where components often cross borders multiple times during production.

- Agriculture: Canada and the U.S. are major global exporters of grain, potash, and other agricultural products. CPKC provides a direct route for these commodities to reach U.S. markets, the Gulf Coast for export, and even Mexico, a significant importer of U.S. and Canadian grains.

- Energy and Chemicals: The network facilitates the movement of crude oil, refined products, and various chemicals, connecting producers in Canada and the U.S. to industrial users and ports.

- Intermodal: The growth of e-commerce and containerized shipping has made intermodal freight a rapidly expanding sector. CPKC’s direct connections between major population centers and ports offer competitive advantages for moving consumer goods efficiently. The KCS legacy even includes a direct rail line to the Port of Lázaro Cárdenas, Mexico, a deep-water port on the Pacific, offering a potential alternative gateway for Asian imports and a faster route for exports to the burgeoning markets of Latin America, bypassing the Panama Canal for some movements.

The "nearshoring" trend, where companies relocate manufacturing closer to their primary markets in North America, further amplifies CPKC’s importance. As businesses seek to reduce reliance on distant supply chains and mitigate geopolitical risks, Mexico is emerging as a preferred destination for new investment. CPKC is perfectly positioned to serve these new industrial parks and facilitate the movement of goods within this reconfigured North American manufacturing landscape.

Operational Excellence and Sustainability

Under Keith Creel’s leadership, CPKC is applying the principles of Precision Scheduled Railroading (PSR) across its expanded network. PSR focuses on maximizing asset utilization, improving velocity, and operating on a fixed schedule, much like a passenger train. This translates to fewer, longer trains, reduced idle time for locomotives and crews, and ultimately, a more reliable and cost-effective service for customers. Safety remains a paramount concern, with significant investments in technology, infrastructure maintenance, and employee training.

Beyond efficiency, CPKC is also emphasizing sustainability. Rail transportation is inherently more environmentally friendly than trucking, emitting significantly less greenhouse gas per ton-mile of freight moved. By shifting freight from roads to rail, CPKC contributes to reducing carbon emissions, fuel consumption, and traffic congestion. The company has articulated ambitious goals for further reducing its carbon footprint through locomotive modernization, operational efficiencies, and exploring alternative fuel technologies.

Challenges and the Road Ahead

While the opportunities for CPKC are immense, the integration of two large, complex organizations is not without its challenges. Harmonizing operating procedures, IT systems, and corporate cultures across three countries requires significant effort and investment. Economic headwinds, such as inflation and potential recessions, could impact freight volumes. Furthermore, the competitive landscape remains robust, with other Class 1 railroads adapting their strategies to counter CPKC’s new advantages.

Despite these hurdles, the long-term outlook for CPKC appears robust. The North American Free Trade Agreement (NAFTA), now updated as the USMCA (United States-Mexico-Canada Agreement), provides a stable framework for cross-border trade, which CPKC is uniquely positioned to facilitate. The demand for efficient, reliable, and sustainable logistics solutions is only set to grow.

As CPKC consolidates its operations and optimizes its new network, it stands as a testament to the enduring power of rail to shape economies and connect nations. From the frozen plains of Canada to the vibrant heart of Mexico, CPKC is not just moving goods; it is laying down the tracks for a more integrated, efficient, and resilient North American future. "We are building something truly special," Creel affirms, "a railway that will serve as the backbone of North American commerce for generations to come." The world watches as CPKC writes the next chapter in the history of continental trade.